Professional Vision. Smarter Crypto Decisions.

Professional Vision. Smarter Crypto Decisions.

Decoding the VIX: More Than Just a Volatility Thermometer?

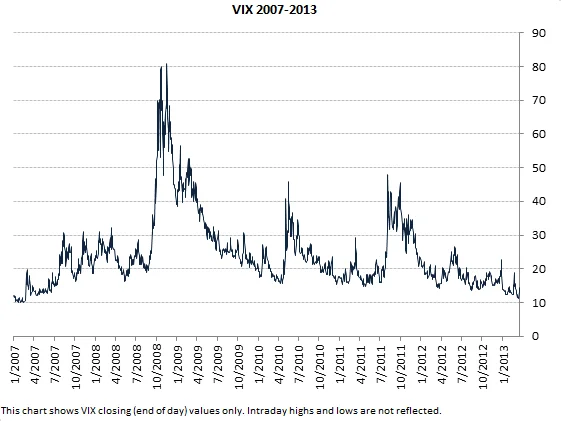

Cboe's VIX, often touted as the market's fear gauge, provides a daily readout of expected volatility. We're told it's the premier indicator, the one to watch when things get dicey. The historical data, stretching back to 1990, is readily available, and custom datasets can be mined for a fee. But, is it really that simple? Is the VIX just a volatility thermometer, or is there something more complex at play?

The VIX wasn't always what it is today. Originally, in 1993, it was based on the S&P 100 (OEX). Then, in 2003, Goldman Sachs helped Cboe revamp it, shifting the foundation to the S&P 500 (SPX). This wasn't just a cosmetic change; it fundamentally altered how the index calculated volatility. The current methodology uses a wider range of SPX options, theoretically providing a more comprehensive view. But does it? I wonder.

The VXO, the original VIX based on the S&P 100, has its own data history, spanning from 1986 to 2003 and then again from 2004 to January 2021, using the old methodology. Comparing the VXO and the VIX provides an interesting case study. The discrepancy between the two indices, especially during periods of market stress, could reveal hidden biases in the VIX's current calculation. Are we truly measuring fear, or are we measuring something else entirely – perhaps the market's reaction to the VIX itself?

Cboe also calculates and disseminates a whole family of volatility indices: VVIX, VIX9D, OVX, GVZ, VXAPL, VXAZN, and VXEEM. Each tracks volatility in different segments of the market. The sheer number of these indices raises a critical question: If the VIX is the "premier gauge," why do we need so many others? Are they designed to provide a more nuanced view, or are they simply attempts to slice and dice the market into ever-smaller, more marketable products?

Cboe provides this data "for the convenience of site visitors." That's nice of them. But there's a catch. Users agree that Cboe isn't liable for any claims arising from "transmission or omissions" in the data. In other words, you can use the data, but if it's wrong, don't come crying to them. That's standard legal boilerplate, of course, but it underscores a crucial point: data, even from a seemingly authoritative source, should always be treated with skepticism.

And this is the part of the report that I find genuinely puzzling. What about the methodology behind the data collection? How are these indices weighted? What specific algorithms are used? Cboe doesn't exactly open the kimono on its calculations. We see the output, but the inner workings remain largely opaque.

Here's a thought leap: How does Cboe gather, clean, and validate the underlying options data that feeds into the VIX calculation? Are there safeguards in place to prevent manipulation or errors? What audit trails exist to ensure the integrity of the data? These questions, crucial for any serious analysis, remain unanswered.

Furthermore, the VIX is often used as a trading signal. But if everyone is watching the same signal, doesn't that create a self-fulfilling prophecy? If enough traders buy put options when the VIX spikes, doesn't that, in turn, drive up the VIX even further, regardless of the underlying market conditions? It's like a hall of mirrors, reflecting and amplifying the initial signal.

The VIX presents itself as a precise, data-driven measure of market volatility. But beneath the surface lies a complex web of assumptions, calculations, and potential biases. It's a valuable tool, to be sure, but it's not a crystal ball. It's more like a weather vane – useful for gauging the direction of the wind, but not necessarily predicting the storm.

The VIX is a Rorschach test for market sentiment. It's not a simple, objective measure, but a complex, multifaceted indicator that reflects both fear and the perception of fear.