Professional Vision. Smarter Crypto Decisions.

Professional Vision. Smarter Crypto Decisions.

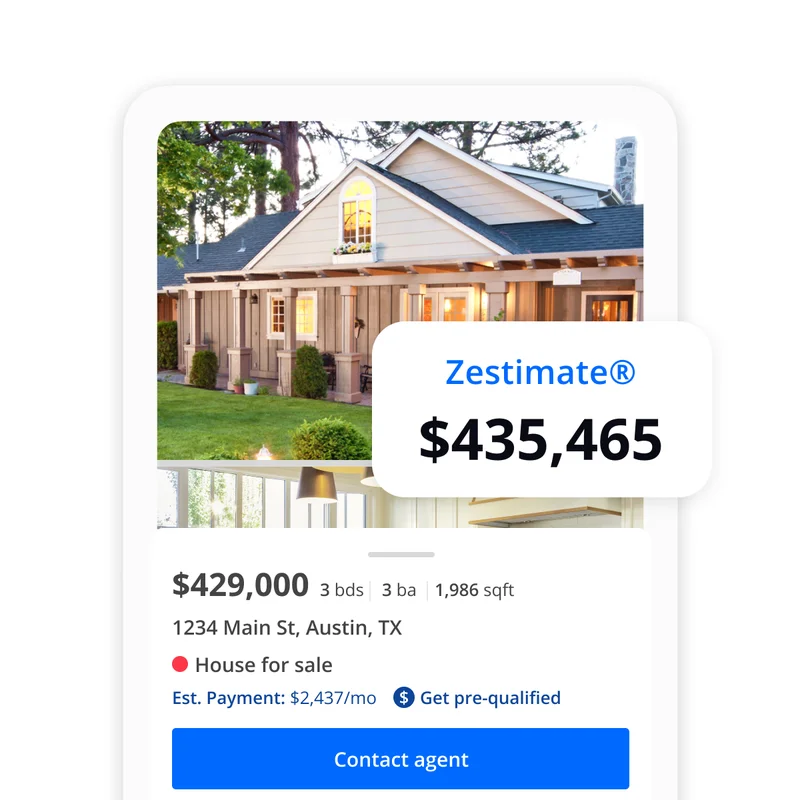

Zillow's latest analysis reveals that the "hidden costs" of owning a home in the U.S. now average nearly $16,000 annually. That's $1,332 a month on top of your mortgage, property taxes, and whatever else you thought you were budgeting for. These are the costs that sneak up on you – the leaky roof, the overgrown landscaping, the sudden need for a new water heater. And according to Zillow, these costs are climbing faster than incomes.

The breakdown is as follows: maintenance accounts for the lion's share at $10,946, followed by property taxes ($3,030) and homeowner's insurance ($2,003). It’s a hefty sum, and it varies wildly depending on location, predictably spiking in already-expensive coastal metros like New York City ($24,381), San Francisco ($22,781), and Boston ($21,320).

But here's where the numbers get particularly interesting, and worrying: insurance premiums. Zillow notes a nationwide increase of 48% over the past five years. But that’s a national average, and averages can be misleading. The real pain is concentrated in specific regions, particularly Florida, where the insurance market is in a state of near-collapse.

Miami, for instance, has seen a 72% jump in annual insurance premiums since 2020, now averaging $4,607. Jacksonville mirrors that increase, while Tampa and Orlando aren't far behind, with increases of 69% and 68%, respectively. Other areas seeing sharp increases include New Orleans (79%), Sacramento (59%), Atlanta (58%), and Riverside, California (56%).

The disparity is stark. Why are some areas seeing such dramatic increases while the national average remains lower? The answer, as always, is complex. Florida's insurance crisis, driven by a combination of extreme weather events and a litigious environment, is a major factor. But it also raises questions about risk assessment and pricing models used by insurance companies. Are these increases justified by the actual risk, or are they, at least in part, a response to regulatory pressures and perceived legal vulnerabilities?

I've looked at hundreds of these real estate reports, and the focus on insurance feels different this time. It's not just a line item anymore; it's a potential deal-breaker. Kara Ng, Zillow's senior economist, puts it bluntly: "Insurance costs are rising nearly twice as fast as homeowner incomes. It's not just a budget line item. It's a barrier to entry." And that's the crux of the issue. These aren't just "hidden costs"; they're hidden barriers, disproportionately affecting first-time buyers and those already struggling with affordability. According to a recent report, Zillow Reveals the Hidden Costs of Homeownership, these costs are rising faster than incomes.

The report also touches on slowing home turnover rates, hitting a three-decade low. This isn't just about rising interest rates; it's about the overall cost of ownership. When you factor in these hidden costs, the equation changes. The dream of homeownership becomes less attainable, and more people are choosing to stay put, further exacerbating the housing shortage.

Zillow suggests potential buyers "plan for maintenance costs early" and consider new-construction homes to avoid unexpected repairs. That’s sound advice, but it also highlights a fundamental problem: the housing market is becoming increasingly bifurcated. New construction is often more expensive, and older homes, while potentially more affordable upfront, come with the risk of costly repairs. It's a risk assessment that many simply can't afford to make.

The rise in hidden costs is like a slow puncture in the tire of the American dream. It might not be immediately noticeable, but over time, it can bring the whole thing grinding to a halt. The question is, what can be done to address this issue? More transparency in pricing? Regulatory reforms to stabilize the insurance market? Or a fundamental re-evaluation of what "affordable" truly means in the context of homeownership?

The numbers don't lie: owning a home is becoming increasingly expensive, and the hidden costs are no longer so hidden. They're a significant barrier, and ignoring them is a recipe for financial strain. It's time for a more honest conversation about the true cost of homeownership in America.